Floodplain Mapping

1968-2002

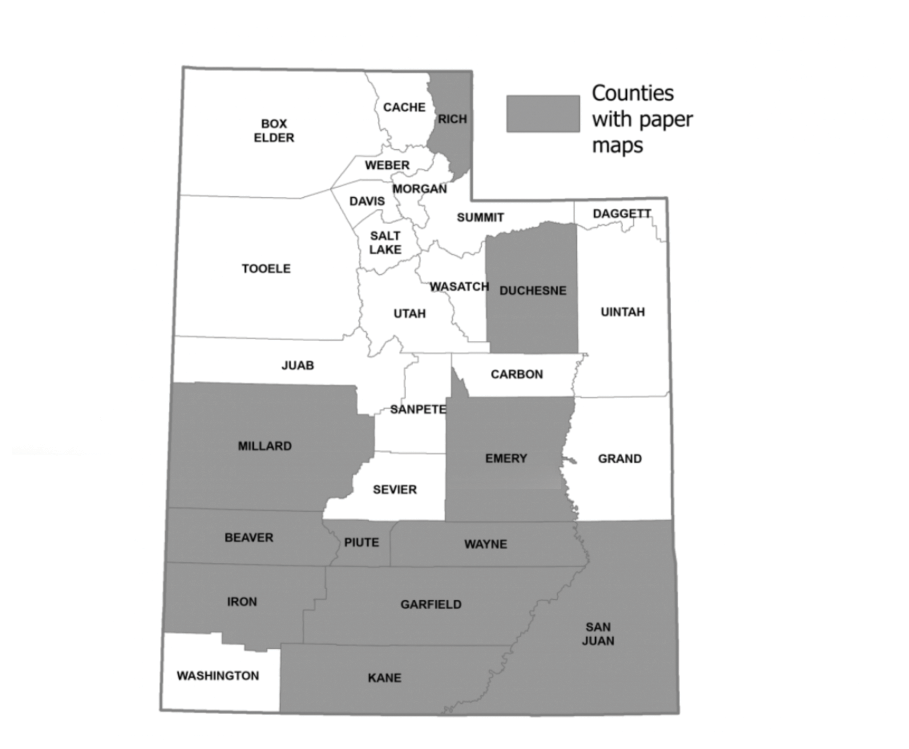

The National Flood Insurance Act of 1968 was motivated by a long history of property damage and loss of life due to flooding. The goal was to provide flood insurance for structures and contents in communities that adopt and enforce an ordinance outlining minimal floodplain management standards. Thus, Floodplain Insurance Rate Maps–or FIRMS–define the boundaries for enacting minimum floodplain standards. 61 Utah communities were mapped by 1980. Many of these maps are still effective but many of the boundaries exist only on paper.

FEMA’s Flood Hazard Boundary Maps (FHBM) were an early form of flood hazard identification. They were developed so that limited amounts of subsidized insurance could be made available for communities before completion of detailed flood insurance studies and FIRMs. Since FHBMs were less detailed than FIRMs and based on approximate data, they were meant to expire once FIRMS were available.

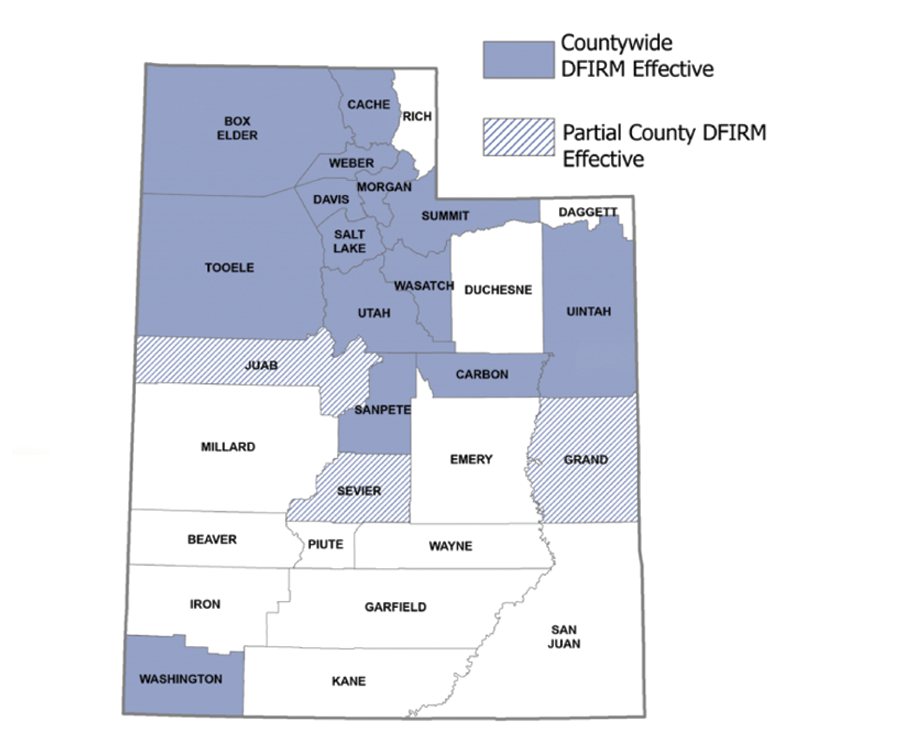

2002-2009

In 2002, Congress appropriated funding for FEMA to "modernize" the nation's flood maps. This "Map Modernization" work upgraded much of the paper-based FIRM inventory into seamless digital flood hazard data. These data became publicly available nationwide via Geographic Information System (GIS) technology.Many of the digitized maps produced during this period did not involve floodplain updates from earlier maps. In some cases, older maps were merely digitized. Section 2 of the current Flood Insurance Study report will have details on the year and method of data collection and creation.

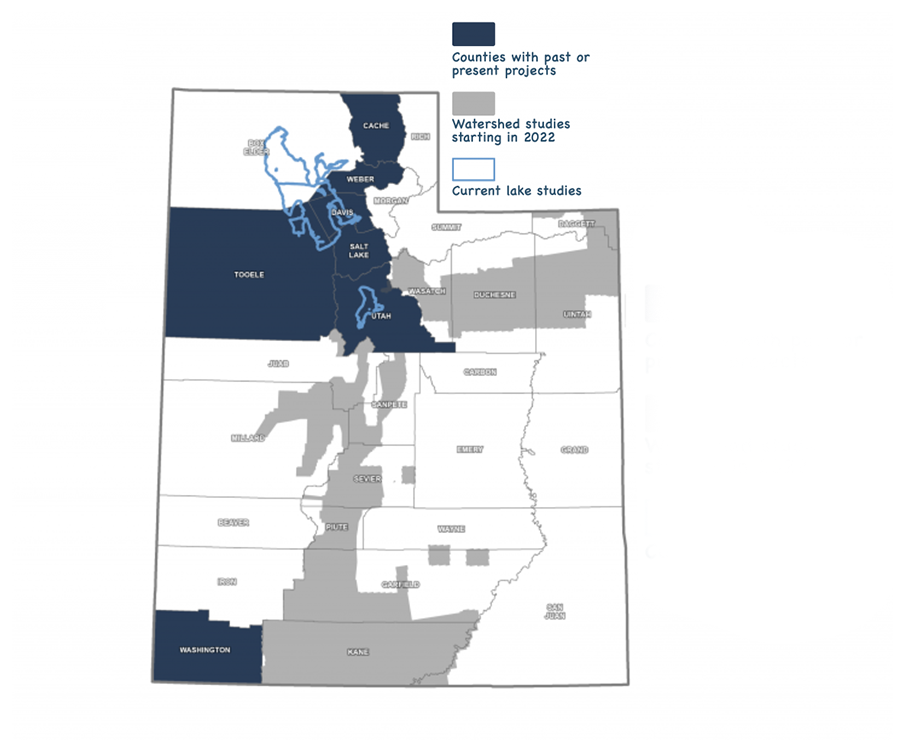

2009-Present

Risk MAP is FEMA'S most recent floodplain mapping program. Up-to-date engineering models and data technologies are used to revise older FIRMS and create new floodplain maps. Each Risk MAP flood risk project is tailored to the needs of the community in question and may involve different products and services. These services might include assistance with mitigation planning and/or outreach support.

Always Evolving...

With Risk Rating 2.0, FEMA now has the capability and tools to address rating disparities by incorporating more flood risk variables. These include flood frequency, multiple flood types—river overflow, storm surge, coastal erosion and heavy rainfall—and distance to a water source along with property characteristics such as elevation and the cost to rebuild.